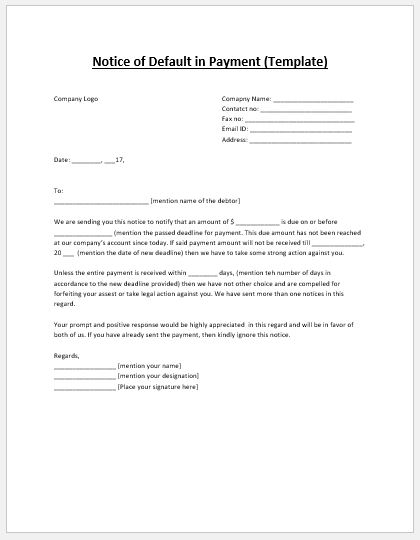

You cannot stop a creditor or lender from sending you a default notice. Using enforcement methods ( bailiffs etc.) if the court issues a CCJ asking you to payĮvery company or creditor chasing you for money must send a Notice of Default before taking further action, as per the CCA.

The CCA 1974 governs some types of credit agreements. The letter is typically sent if you have not paid the full amount agreed within your credit agreement over three to six months.Īs it is a notice, you are given a minimum of 14 days to catch up by paying what you owe.ĭefault notices can only be issued on debts that are regulated by the CCA. What is a Notice of Default?Ī Notice of Default is a communication from your creditor, informing you that you are behind on repayments and your account is soon to default. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact find, MoneyNerd doesn’t give advice.

0 kommentar(er)

0 kommentar(er)